what is suta taxable

The states requiring employee contributions are Alaska New. Specific industries with higher rates of turnovers might experience an increase in SUTA tax rates.

Practicing The Three Payroll Journal Entries Youtube

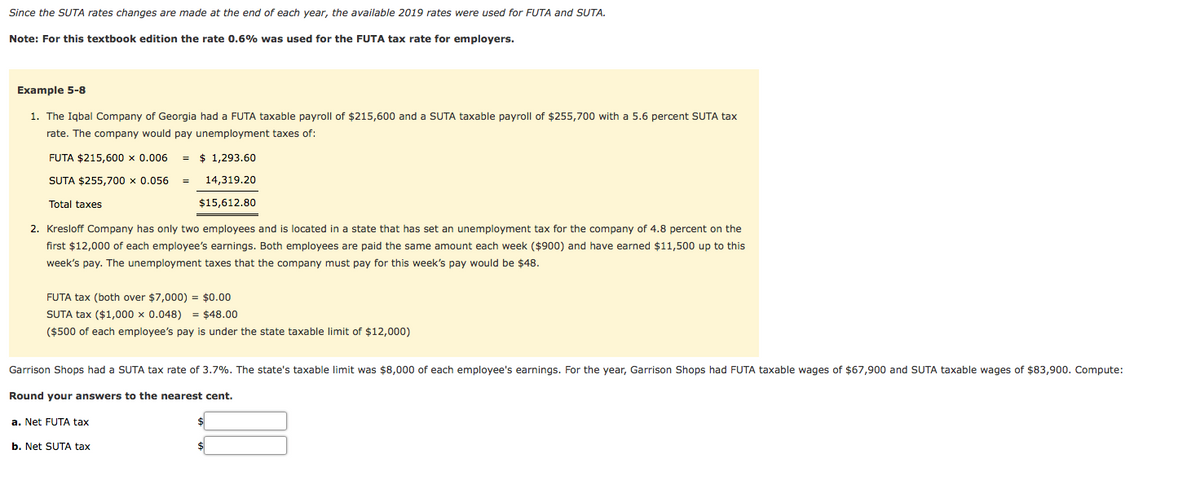

Employers pay two types of unemployment taxes.

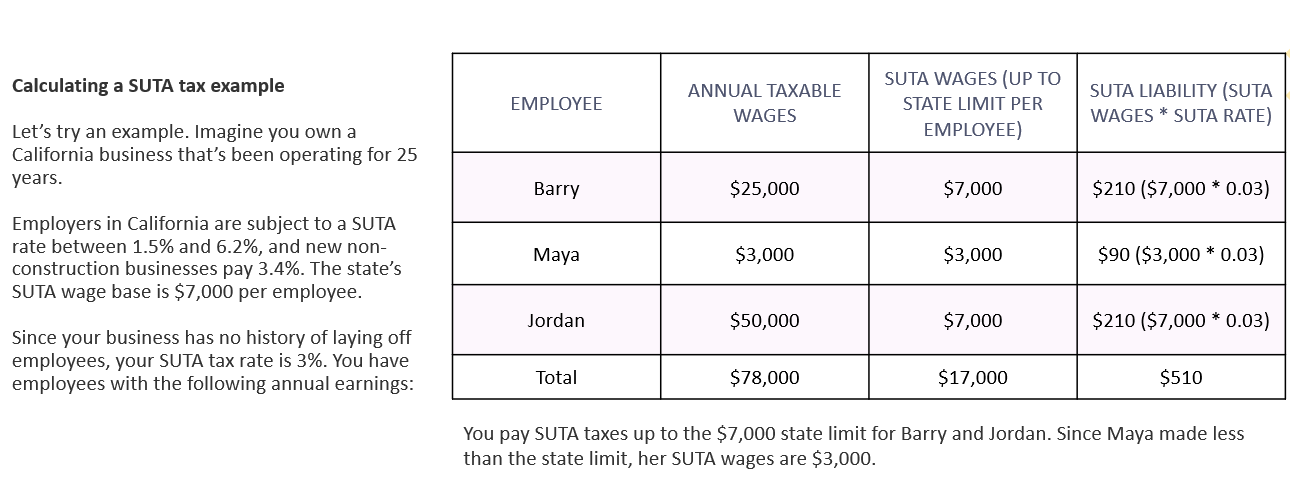

. SUTA is a payroll tax required from employers. The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. Government employers nonprofits educational and charitable institutions are exempt from these taxes.

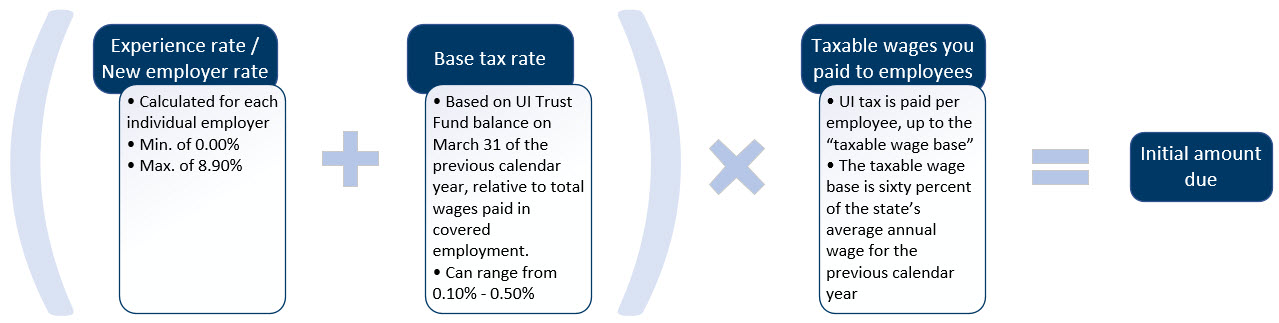

To calculate the amount of unemployment insurance tax. This tax is a payroll tax that businesses must pay to fund unemployment benefits. File Wage Reports Pay Your Unemployment Taxes Online.

State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment. The ranges are wide. These taxes are placed in a states unemployment fund.

The best negative-rate class was assigned a rate of. In some cases however the employee may also have to pay. The FUTA and SUTA taxes are filed on Form 940 each year.

Fortunately most employers pay little SUTA tax if they. As mentioned in some states employees contribute to SUTA but in all states the employer pays SUTA taxes. Benefit Rights - The following information is a summary of the legal requirements and your rights and responsibilities while filing a claim for unemployment insurance benefits.

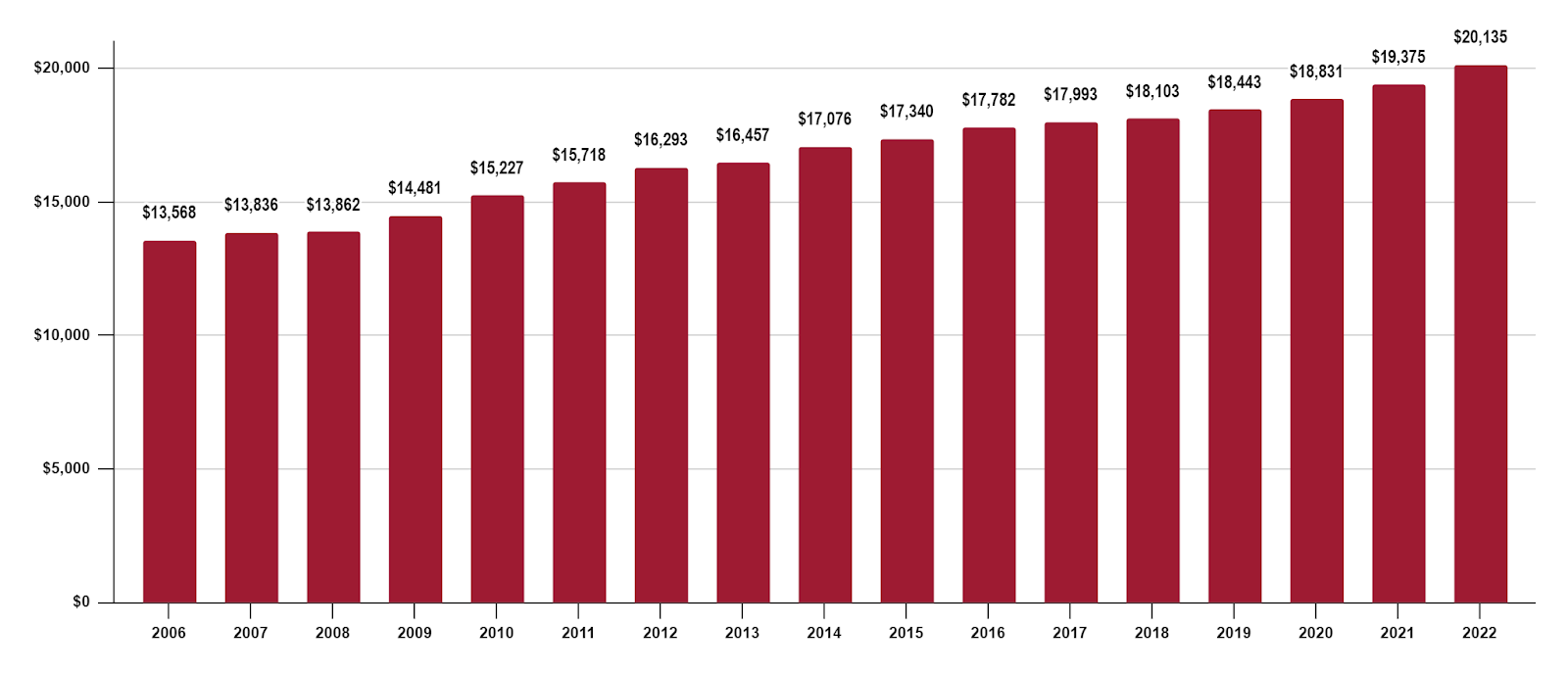

Employers with stable employment records receive reduced tax rates after a qualifying. Read all of this. SUTA rates in each state typically range from 065 to 068.

What is SUTA. General employers are liable if they have had a quarterly payroll of 1500. Many states collect an additional unemployment tax from employers known as state unemployment taxes SUTA.

SUTA isnt as cut and dry as the FUTA as it varies by state. These range from 2 to 5 of an employees wages. Kentuckys range for example is 03 to 9.

Each state decides on its SUTA tax rate range. Its also known as state unemployment insurance SUI. The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base.

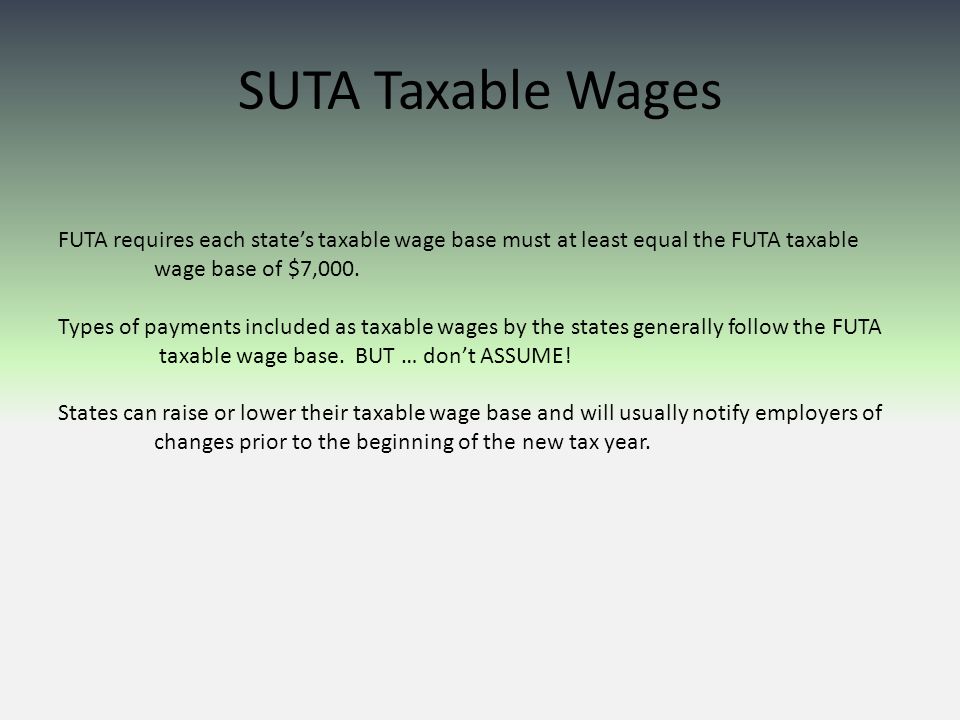

These benefits are provided to qualifying employees by the. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. SUTA is short for State Unemployment Tax Act.

Only the first 7000 of wages paid to each employee by their employer in a calendar year is taxable. Additionally wages earned by employees younger than 21 are not required to be taxed. New companies usually face a standard rate.

Unemployment Tax Rates Employers Unemployment Insurance Minnesota

Suta Tax Requirements For Employers State By State Guide

Chapter 5 Homework Docx Chapter 5 Homework Since The Suta Rates Changes Are Made At The End Of Each Year And There Is Much Discussion About Changes To Course Hero

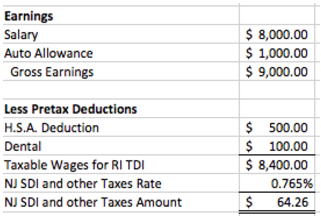

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Answered Garrison Shops Had A Suta Tax Rate Of Bartleby

Unemployment Insurance Taxes Iowa Workforce Development

What Is Suta Tax Definition Rates Example More

Unemployment Insurance Taxes Iowa Workforce Development

View All Hr Employment Solutions Blogs Workforce Wise Blog

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Pt 3 7 Ps 7 Federal Unemployment Tax Who Pays Futa Exempt Wages Exempt Employment Futa Tax Rate Wage Base Depositing Reporting Futa Ppt Download

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Employer Taxes 101 Fica Futa Suta Decoded

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes