tax benefit rule state tax refund

98369 amended section generally substituting provisions relating to recovery of tax benefit items for provisions relating to recovery of bad. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the.

What Is Income Tax Return Meaning And Benefits Hdfc Life

Whether state refunds are includable on a federal return depends on the tax benefit rule.

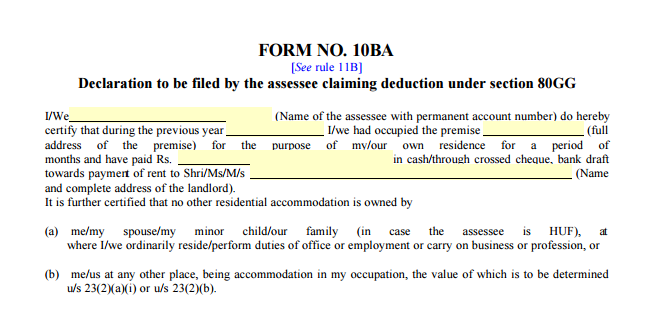

. As the Tax Court explained under the tax benefit rule as it applies to state income tax refunds for a taxpayer to be able to exclude a state income tax refund payment from income the refund payment must be for an overpayment of tax for which the taxpayer did not take a federal tax deduction when it was paid in a preceding year. Example of the Tax Benefit Rule. Simply stated the refunds recoveries are taxable only to the extent the taxpayer received a tax benefit from the deductionthat is the deduction must have reduced taxes or.

WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. A received a tax benefit from. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020.

Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2021. Had A paid only the proper amount of state income tax in 2018 As state and local tax deduction would have been reduced from 9000 to 7500 and as a result As itemized deductions would have been reduced from 14000 to 12500 a difference of 1500. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayers federal income tax return.

The rule says if a refund can be linked to a prior deduction which the taxpayer actually benefitted from then the refund is taxable to the extent of that benefit. Tax treatment of state and local tax refunds clarified. Copyright 2008 HR Block.

The most common situation would be that you deducted your state and local income taxes on your 2018 return and then received a state tax refund during the calendar year 2019. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period. The rule is promulgated by the Internal Revenue Service.

In year 2 your income is increased such that you eventually get taxed and the gimmick fails. The most common example is a state income tax refund of tax deducted in the prior year. If a state or local income tax refund is received during the tax year the refund must generally be included in income if the taxpayer deducted the tax in an earlier year.

If an amount is zero enter 0. 79-15 no tax benefit You can see Im old since I have been doing this since 1982 and I still remember RR 79-15. Their AGI was 92325 and itemized deductions were 27400 which included 6850 in state income tax and no other state or local taxes.

Some tax software have been providing reports of potentially taxable refunds based on the ratio calculation. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the earlier year. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit.

Their AGI was 85000 and itemized deductions were 25100 which included 7000 in state income tax and no other state or local taxes. The question was whether a portion of the refund equal to the refund amounts times the ratio of income taxes to total state and local taxes subject to the 10000 limit will be considered taxable in 2019. It shouldnt but it is not programmed like the 1040.

If an amount is zero enter 0. 99514 1812a2 substituted reducing tax imposed by this chapter for reducing income subject to tax or reducing tax imposed by this chapter as the case may be. There are other kinds of recovery items but the most common is a state tax refund.

One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax refunds. The entire amount recovered in the current year had given the taxpayer a tax benefit. If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income.

When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600. 1500 refund of state income taxes paid in 2018. Myrna and Geoffrey filed a joint tax return in 2020.

If the total amount of itemized deduction for 2012 was 6175 you only have to claim 225 of the refund as income in 2013. A state income tax refund is a recovery item whose taxability on your federal return is governed by the tax benefit rule of Internal Revenue Code section 111. Enter the refund as income then back it out As per Rev.

The 1000 deduction for state and local income taxes you claimed on the. What is the Tax Benefit Rule. In applying the AMT nonrefundable credits tax benefit rule to state income tax refunds the program assumes that if there was any tax benefit received in 20XX by deducting the entire amount of state income taxes refunded then the full amount of the refund after accounting for other adjustments is taxable.

Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in year 1 and then get the money refunded to you in year 2. Myrna and Geoffrey filed a joint tax return in 2019. A state tax refund is taxable income if you received a tax benefit by deducting your state income taxes on a previous tax return.

State tax refunds are only SOMETIMES taxable on the 1040.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

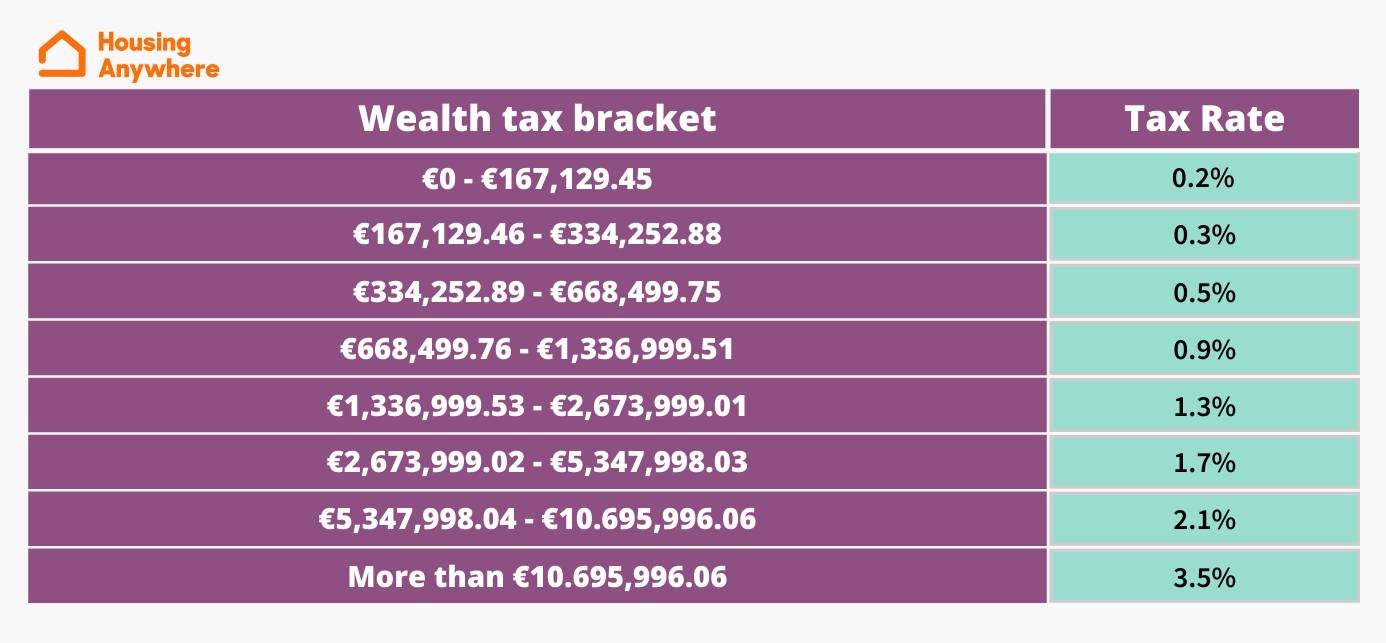

How To File An Income Tax Return In Spain Expatica

How To File An Income Tax Return In Spain Expatica

Income Tax Rule Change Tripple Tax Benefits On Nps Know How It Works Who Can Claim In 2022 Income Tax Return Income Tax Tax Rules

How To File An Income Tax Return In Spain Expatica

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is Irs Treas 310 And How Is It Related To 2020 Tax Returns As Usa

Tax Agency 2021 Income Tax Practical Guide

State Income Tax Returns And Unemployment Compensation

What Is The Standard Deduction Tax Policy Center

How To Pay Tax In Spain And What Is The Tax Free Allowance

How To File An Income Tax Return In Spain Expatica

Income Tax It Returns Rules What Is Income Tax For Fy 2021 22